- Latest available (Revised)

- Point in Time (01/02/1991)

- Original (As enacted)

Finance Act 1982

You are here:

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes over time for: Part I

Version Superseded: 01/09/1994

Alternative versions:

- 01/02/1991- Amendment

- 01/02/1991

Point in time - 01/09/1994- Amendment

Status:

Point in time view as at 01/02/1991.

Changes to legislation:

There are currently no known outstanding effects for the Finance Act 1982, Part I.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Part IU.K. General Provisions

Vehicles chargeable at the basic rate of dutyU.K.

1(1)Subject to paragraphs 5 and 6 below, the annual rate of duty applicable to a goods vehicle—

(a)which has a plated gross weight or a plated train weight which does not exceed 7.5 tonnes; or

(b)which has neither a plated gross weight nor a plated train weight but which has an unladen weight which exceeds 1,525 kilograms; or

(c)which is a tower wagon, having an unladen weight which exceeds 1,525 kilograms;

shall be £170.

(2)Any reference in the following provisions of this Schedule to the basic rate of duty is a reference to the annual rate of duty for the time being applicable to vehicles falling within sub-paragraph (1) above.

Vehicles exceeding 7.5 but not exceeding 12 tonnes plated weightU.K.

2Subject to paragraphs 1(1)(c) above and 6 below, the annual rate of duty applicable to a goods vehicle which has a plated gross weight or a plated train weight which exceeds 7.5 tonnes but does not exceed 12 tonnes shall be £360.

Rigid goods vehicles exceeding 12 tonnes plated gross weightU.K.

3(1)Subject to the provisions of this Schedule, the annual rate of duty applicable to a goods vehicle which is a rigid goods vehicle and has a plated gross weight which exceeds 12 tonnes shall be determined in accordance with Table A in Part II of this Schedule by reference to—

(a)the plated gross weight of the vehicle; and

(b)the number of axles on the vehicle.

(2)If a rigid goods vehicle to which sub-paragraph (1) above applies is used for drawing a trailer which—

(a)has a plated gross weight exceeding 4 tonnes; and

(b)when so drawn, is used for the conveyance of goods or burden;

the annual rate of duty applicable to it in accordance with that sub-paragraph shall be increased by the amount of the supplement which, in accordance with Table B in Part II of this Schedule, is appropriate to the gross plated weight of the trailer being drawn.

Tractor units exceeding 12 tonnes plated train weightU.K.

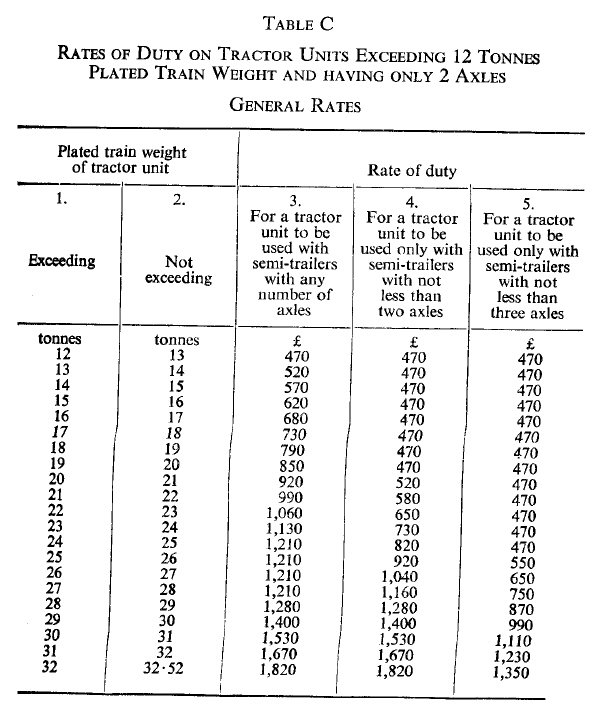

4(1)This paragraph applies to a tractor unit which has a plated train weight exceeding 12 tonnes.

(2)The annual rate of duty applicable to a tractor unit to which this paragraph applies and which has not more than two axles shall be determined, subject to the followingh provisions of this Schedule, in accordance with Table C in Part II of this Schedule by reference to—

(a)the plated train weight of the tractor unit; and

(b)the types of semi-trailers, distinguished according to the number of their axles, which are to be drawn by it.

(3)The annual rate of duty applicable to a tractor unit to which this paragraph applies and which has three or more axles shall be determined subject to the following provisions of this Schedule in accordance with Table D in Part II of this Schedule by reference to—

(a)the plated train weight of the tractor unit; and

(b)the types of semi-trailers, distinguished according to the number of their axles, which are to drawn by it.

Special types of vehiclesU.K.

5(1)This paragraph applies to a goods vehicle—

(a)which has an unladen weight exceeding 1,525 kilograms; and

(b)which does not comply with regulations under section 40 of the M1Road Traffic Act 1972 (construction and use regulations); and

(c)which is for the time being authorised for use on roads by virtue of an order under section 42 of that Act (authorisation of special vehicles).

(2)The annual rate of duty applicable to a goods vehicle to which this paragraph applies and which falls within a class specified by an order of the Secretary of State made for the purposes of this paragraph shall be determined, on the basis of the assumption in sub-paragraph (3) below, by the application of Table A, Table C or Table D in Part II of this Schedule, according to whether the vehicle is a rigid goods vehicle or a tractor unit and, in the latter case, according to the number of its axles.

(3)The assumptions referred to in sub-paragraph (2) above are—

(a)where Table A applies, that the vehicle has a plated gross weight which exceeds 30 tonnes but does not exceed 30.49 tonnes; and

(b)where Table C or Table D applies, that the vehicle has a plated train weight which exceeds 32 tonnes but does not exceed 32.52 tonnes.

(4)In the case of a goods vehicle to which this paragraph applies and which does not fall within such class as is referred to in sub-paragraph (2) above, the annual rate of duty shall be the basic rate of duty.

(5)The power to make an order under sub-paragraph (2) above shall be exercisable by statutory instrument ; but no such order shall be made unless a draft of it has been laid before Parliament and approved by a resolution of each House of Parliament.

Marginal Citations

Farmer’s goods vehicles and showmen’s goods vehiclesU.K.

6(1)If the unladen weight of—

(a)a farmer’s goods vehicle; or

(b)a showman’s goods vehicle;

does not exceed 1,525 kilograms, the annual rate of duty applicable to it shall be £60.

(2)If a farmer’s goods vehicle or a showman’s goods vehicle has a plated gross weight or a plated train weight, the annual rate of duty applicable to it shall be—

(a)£100, if that weight does not exceed 7.5 tonnes;

(b)£130, if that weight exceeds 7.5 tonnes but does not exceed 12 tonnes; and

(c)the appropriate Part II rate, if that weight exceeds 12 tonnes.

(3)In sub-paragraph (2) above the “appropriate Part II rate” means the rate determined in accordance with paragraph 3 or, as the case may be, 4 above but by reference—

(a)in the case of a farmer’s goods vehicle, to Table A(1), Table B(1), Table C(1) or, as the case may be, Table D(1) in Part II of this Schedule, in place of the corresponding Table referred to in that paragraph; and

(b)in the case of a showman’s goods vehicle, to Table A(2), Table B(2), Table C(2) or, as the case may be, Table D(2) in Part II of this Schedule, in place of the corresponding Table referred to in that paragraph.

(4)In the case of any other farmer’s goods vehicle or showman’s goods vehicle, the annual rate of duty applicable to it shall be £100.

Smaller goods vehiclesU.K.

7If a goods vehicle—

(a)has an unladen weight which does not exceed 1,525 kilograms; and

(b)does not fall within paragraph 6 above;

the annual rate of duty applicable to it shall be £80.

Vehicles treated as having reduced plated weightsU.K.

8(1)The Secretary of State may by regulations provide that, on an application made in accordance with the regulations, the goods vehicle to which the application relates shall be treated for the purposes of this Schedule as if its plated gross weight or plated train weight (the “operating weight”) specified in the application.

(2)Where, following an application duly made in accordance with the regulations, a licence is issued for the vehicle concerned at the rate of duty applicable to the operating weight, that weight shall be shown on the licence.

(3)The regulations may provide that the use of any vehicle in respect of which a lower rate of duty is chargeable by virtue of this paragraph shall be subject to prescribed conditions and to such further conditions as the Secretary of State may think fit to impose in any particular case.

(4)In any case where a vehicle in respect of which a lower rate of duty has been charged by virtue by virtue of this paragraph is used in contravention of a condition imposed by virtue of sub-paragraph (3) above, then—

(a)the higher rate of duty applicable to its plated gross weight or plated train weight shall become chargeable as from the date of the contravention; and

(b)section 19 of this Act shall apply as if—

(i)that higher rate had become chargeable under subsection (1) of that section by reason of the vehicle being used as mentioned in that subsection; and

(ii)subsections (5) to (9) were omitted.

Plated and unladen weightsU.K.

9(1)Any reference in this Schedule to the plated gross weight of a goods vehicle or trailer is a reference—

(a)to that plated weight, within the meaning of Part II of the Road Traffic Act 1972, which is the maximum gross weight which may not be exceeded in Great Britain for the vehicle or trailer in question; or

(b)in the case of any trailer which may lawfully be used in Great Britain without a plated gross weight, to the maximum laden weight at which the trailer may lawfully be used in Great Britain.

(2)Any reference in this Schedule to the plated train weight of a vehicle is a reference to that plated weight, within the meaning of the said Part II, which is the maximum gross weight which may not be exceeded in Great Britain for an articulated vehicle consisting of the vehicle in question and any semi-trailer which may be drawn by it.

(3)A mechanically propelled vehicle which—

(a)is constructed or adapted for use and used for the conveyance of a machine or contrivance and no other load except articles used in connection with the machine or contrivance; and

(b)is not a vehicle for which an annual rate of duty is specified in Schedule 3 to this Act; and

(c)has neither a plated gross weight nor a plated train weight,

shall, notwithstanding that the machine or contrivance is built in as part of the vehicle, be chargeable with duty at the rate which would be applicable if the machine or contrivance were burden.

Goods vehicles used partly for private purposesU.K.

10(1)Where a goods vehicle is partly used for private purposes, the annual rate of duty applicable to it shall, if apart from this paragraph it would be less, be the rate determined in accordance with Schedule 5 to this Act.

(2)A vehicle shall not be prevented from being a farmer’s goods vehicle for the purposes of this Schedule solely by reason of its being used partly for private purposes.

(3)In this paragraph “partly used for private purposes” means used partly otherwise than for the conveyance of goods or burden for hire or reward or for or in connection with a trade or business.

Exempted vehiclesU.K.

11Duty shall not be chargeable by virtue of this Schedule in respect of—

(a)a vehicle chargeable with duty by virtue of Schedule 1 to this Act;

(b)an agricultural machine which is a goods vehicle by reason of the fact that it is constructed or adapted for use, and used, for the conveyance of farming or forestry implements fitted to it for operation while so fitted;

(c)a mobile crane, works truck or fisherman’s tractor; or

(d)a vehicle which, though constructed or adapted for use for the conveyance of goods or burden, is not so used for hire or reward or for or in connection with a trade or business.

12(1)This paragraph and paragraph 13 below apply to agricultural machines which do not draw trailers.

(2)Subject to paragraph 13 below, a vehicle to which this paragraph applies shall not be chargeable with duty by virtue of this Schedule by reason of the fact that it is constructed or adapted for use and used for the conveyance of permitted goods or burden if they are carried in or on not more than one appliance and the conditions mentioned in sub-paragraph (3) below are satisfied.

(3)The conditions are that—

(a)the appliance is fitted either to the front or to the back of the vehicle;

(b)the appliance is removable;

(c)the area of the horizontal plane enclosed by verticle lines passing through the outside edges of the appliance is not, when the appliance is in the position in which it is carried when the vehicle is travelling and the appliance is loaded, greater than—

(i)0.65 of a square metre, if the appliance is carried at the front; or

(ii)1.394 square metres, if it is carried at the back.

(4)In sub-paragraph (2) above “permitted goods or burden” means goods or burden the haulage of which is permissable under paragraph 2(1) of Schedule 3 to this Act.

(5)Sub-paragraph (2) above does not apply—

(a)to the use of a vehicle on a public road more than 15 miles from a farm occupied by the person in whose name the vehicle is registered under this Act;

(b)to three-wheeled vehicles; or

(c)to any vehicle in respect of which the distance between the centre of the area of contact with the road surface of the relevant wheel and that of the nearest wheel on the other side of the vehicle is less than 1.22 metres.

(6)In sub-paragraph (5)(c) above “relevant wheel” means—

(a)in a case where only one appliance is being used for the carriage of goods or burden and that appliance is fitted to the back of the vehicle, a back wheel; and

(b)in any other case, any wheel on a side of the vehicle.

(7)For the purposes of this paragraph a vehicle which has two wheels at the front shall, if the distance between them (measured between the centres of their respective areas of contact with the road) is less than 46 centimetres, be treated as a three-wheeled vehicle.

13(1)This paragraph shall have effect in relation to any vehicle fitted with an appliance of any description prescribed for the purposes of all or any of the provisions of this paragraph by regulations under this paragraph.

(2)The limitation in paragraph 12(2) above to one appliance shall have effect as a limitation to two appliances of which at least one must be an appliance prescribed for the purposes of this sub-paragraph ; but if two appliances are used they must be fitted at opposite ends of the vehicle.

(3)Regulations under this paragraph may provide for all or any of the following matters where an appliance prescribed for the purposes of this paragraph is being used, that is to say, that paragraph 12(2) above shall not apply unless the prescribed appliance is fitted to the prescribed end of the vehicle, or unless the use of the prescribed or any appliance is limited to prescribed goods or burden or to use in prescribed circumstances.

(4)Regulations under this paragraph may provide that paragraph 12(3)(c) above shall not have effect in relation to appliances prescribed for the purposes of this sub-paragraph, but that in relation to those appliances paragraph 12(5)(a) above shall have effect with the substitution of such shorter distance as may be prescribed.

(5)In sub-paragraphs (2) to (4) above references to use are references to use for the carriage of goods or burden ; and regulations under this paragraph may make different provision in relation to different descriptions of prescribed appliances.

Tractor units used with semi-trailers having only one axle when duty paid by reference to use with semi-trailers having more than one axleU.K.

14(1)This paragraph applies in any case where—

(a)a vehicle licence has been taken out for a tractor unit having two axles which is to be used only with semi-trailers with not less than two axles or for a tractor unit having two axles which is to be used only with semi-trailers with not less than three axles; and

(b)the rate of duty paid on taking out the licence is equal to or exceeds the rate of duty applicable to a tractor unit having two axles—

(i)which has a plated train weight equal to the maximum laden weight at which a tractor unit having two axles may lawfully be used in Great Britain with a semi-trailer with a single axle; and

(ii)which is to be used with semi-trailers with any number of axles.

(2)If, in a case to which this paragraph applies, the tractor unit is used with a semi-trailer with a single axle and, when so used, the laden weight of the tractor unit and semi-trailer taken together does not exceed the maximum laden weight mentioned in sub-paragraph (1)(b)(i) above, the tractor unit shall, when so used, be taken to be licensed in accordance with the requirements of this Act.

InterpretationU.K.

15(1)In this Schedule, unless the context otherwise requires—

“agricultural machine” has the same meaning as in Schedule 3 to this Act;

“axle” includes—

(i)two or more stub axles which are fitted on opposite sides of the longitudinal axis of the vehicle so as to form—

(a)a pair in the case of two stub axles, and

(b)pairs in the case of more than two stub axles,

(ii)a single stub axle which is not one of a pair; and

(iii)a retractable axle;

“basic rate of duty” has the meaning given by paragraph 1(2);

“business” includes the performance by a local or public authority of its functions;

“farmer’s goods vehicle” means, subject to paragraph 10(2) above, a goods vehicle registered under this Act in the name of a person engaged in agriculture and used on public roads solely by him for the purpose of the conveyance of the produce of, or of articles required for the purposes of, the agricultural land which he occupies, and for no other purposes;

“fishermen’s tractor” has the same meaning as in Schedule 3 to this Act;

“goods vehicle” means a mechanically propelled vehicle (including a tricycle as defined in Schedule 1 to this Act and weighing more than 425 kilograms unladen) constructed or adapted for use and used for the conveyance of goods or burden of any description, whether in the course of trade or otherwise;

“mobile crane” has the same meaning as in Schedule 3 to this Act;

“rigid goods vehicle” means a goods vehicle which is not a tractor unit;

“showman’s goods vehicle” means a showman’s vehicle which is a goods vehicle and is permanently fitted with a living van or some other special type of body or superstructure, forming part of the equipment of the show of the person in whose name the vehicle is registered under this Act;

“showman’s vehicle” has the same meaning as in Schedule 3 to this Act;

“stub axle” means an axle on which only one wheel is mounted;

“tower wagon” means a goods vehicle—

(a)into which there is built, as part of the vehicle, any expanding or extensible contrivance designed for facilitating the erection, inspection, repair or maintenance of overhead structures or equipment; and

(b)which is neither constructed nor adapted for use nor used for the conveyance of any load, except such a contrivance and articles used in connection therewith;

“tractor unit” means a goods vehicle to which a semi-trailer may be so attached that part of the semi-trailer is super-imposed on part of the goods vehicle and that when the semi-trailer is uniformly loaded not less than 20 per cent. of the weight of its load is borne by the goods vehicle;

“trailer” shall be construed in accordance with sub-paragraph (2) below;

“unladen weight” has the same meaning as it has for the purposes of the M2Road Traffic Act 1972 by virtue of section 194 of that Act; and

“works truck” has the same meaning as in Schedule 3 to this Act.

(2)In this Schedule “trailer” does not include—

(a)an appliance constructed and used solely for the purpose of distributing on the road loose gritting material;

(b)a snow plough;

(c)a road construction vehicle as defined in section 4(2) of this Act;

(d)a farming implement not constructed or adapted for the conveyance of goods or burden of any description, when drawn by a farmer’s goods vehicle;

(e)a trailer used solely for the carriage of a container for holding gas for the propulsion of the vehicle by which it is drawn, or plant and materials for producing such gas.

Marginal Citations

Options/Help

Print Options

PrintThe Whole Act

PrintThe Whole Schedule

PrintThis Part only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources