- Latest available (Revised)

- Point in Time (22/03/2013)

- Original (As enacted)

Aircraft and Shipbuilding Industries Act 1977 (repealed)

You are here:

- UK Public General Acts

- 1977 c. 3

- Whole Act

- Previous

- Next

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes over time for: Aircraft and Shipbuilding Industries Act 1977 (repealed)

Version Superseded: 26/05/2015

Alternative versions:

- 01/02/1991- Amendment

- 02/02/1991- Amendment

- 31/07/1991- Amendment

- 01/10/1991- Amendment

- 01/10/1992- Amendment

- 16/10/1992- Amendment

- 31/03/1995- Amendment

- 01/01/1996- Amendment

- 24/09/1996- Amendment

- 31/01/1997- Amendment

- 01/08/1998- Amendment

- 19/11/1998- Amendment

- 24/06/2003- Amendment

- 22/07/2004- Amendment

- 28/11/2004- Amendment

- 28/09/2005- Amendment

- 03/04/2006- Amendment

- 29/06/2006- Amendment

- 06/04/2008- Amendment

- 01/10/2009- Amendment

- 12/04/2010- Amendment

- 22/04/2011- Amendment

- 22/03/2013- Amendment

- 22/03/2013

Point in time - 26/05/2015- Amendment

Status:

Point in time view as at 22/03/2013.

Changes to legislation:

There are currently no known outstanding effects for the Aircraft and Shipbuilding Industries Act 1977 (repealed).![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Aircraft and Shipbuilding Industries Act 1977

1977 CHAPTER 3

An Act to provide for the establishment of two bodies corporate to be called British Aerospace and British Shipbuilders, and to make provision with respect to their functions; to provide for the vesting in British Aerospace of the securities of certain companies engaged in manufacturing aircraft and guided weapons and the vesting in British Shipbuilders of the securities of certain companies engaged in shipbuilding and allied industries; to make provision for the vesting in those companies of certain property, rights and liabilities; to provide for payments to British Aerospace and its wholly owned subsidiaries, for the purpose of promoting the design, development and production of civil aircraft; and for connnected purposes.

[17th March 1977]

Commencement Information

I1Act wholly in force at Royal Assent, but see ss. 19 and 56 for minor variations.

PART IU.K. The Corporations

Modifications etc. (not altering text)

C1By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that Pt. I is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say British Shipbuilders)

Constitution and functionsU.K.

F11 British Aerospace and British Shipbuilders.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Subordinate Legislation Made

P1S. 1: power exercised by S.I. 1977/626

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F2U.K.

Textual Amendments

F2S. 2 repealed by British Shipbuilders Act 1983 (c. 15, SIF 64), s. 1(2), Sch.

F13 Powers of the Corporations.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F14 Corporations to give effect to directions of Secretary of State.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F1[F34A] Organisation of British Shipbuilders’ activities.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F3Ss. 4A, 4B inserted by British Shipbuilders Act 1983 (c. 15, SIF 64), s. 2(1)

F1[F44B] Discontinuance and restriction of British Shipbuilders activities.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F4Ss. 4A, 4B inserted by British Shipbuilders Act 1983 (c. 15, SIF 64), s. 2(1)

5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F5U.K.

Textual Amendments

F5S. 5 repealed by British Shipbuilders Act 1983 (c. 15, SIF 64), s. 3(3), Sch.

F16 Machinery for settling terms and conditions of employment etc.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F17 Formulation of the Corporations’ policies and plans and conduct of their operations.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

8 Furnishing and publication of information by the Corporations.U.K.

(1)In such manner and at such times as the Secretary of State may specify in relation to it, each Corporation shall furnish the Secretary of State with such information—

(a)as he may specify in writing to it, and

(b)as the Corporation has or can reasonably be expected to obtain,

with respect to such matters relating to the Corporation or its wholly owned subsidiaries or the activities (past, present or future), plans or property of any of them as the Secretary of State may so specify.

(2)The Secretary of State may, by directions given to either Corporation, require it to publish, in such manner as may be specified in the directions, such information as may be so specified relating to—

(a)the operations of the Corporation and its wholly owned subsidiaries; and

(b)its policy and plans for the general conduct of its undertaking and the businesses of all or any of its wholly owned subsidiaries.

(3)Before giving any directions under subsection (2) above the Secretary of State shall consult the Corporation to which they are to be given.

F19 Control by Corporations of wholly owned subsidiaries.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

Financial provisionsU.K.

F110 Financial duties of the Corporations.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F111 Borrowing powers of the Corporations and their wholly owned subsidiaries.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F112 Loans by the Secretary of State to the Corporations.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F113 Treasury guarantees.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F114 Transfer to Corporations of rights and obligations with respect to certain government loans.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F115 The commencing capital of each Corporation.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F116 Public dividend capital and public dividends.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1Ss. 1-16 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2)

F617 Accounts and audit.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F6S. 18 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2) (with Sch. 1 para. 3(5))

F618 Annual report.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F6S. 18 repealed (22.3.2013) by The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(2) (with Sch. 1 para. 3(5))

Part IIU.K. Vesting of Securities and other Assets in the Corporations and acquired Companies

Acquisition of securities and assetsU.K.

19 Vesting in British Aerospace or British Shipbuilders of securities of Scheduled companies. U.K.

(1)Subject to the provisions of this Part of this Act, on the aircraft industry vesting date all securities of the companies which on 29th October 1974 were known by the names specified on Part I of Schedule 1 to this Act, being the companies other than any excepted company which on that date fulfilled the conditions in Part II of that Schedule, shall, by virtue of this section, vest in British Aerospace free from all trusts and incumbrances.

F7(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3)[F8Each Corporation shall, in respect of the securities of any company which vest in it by virtue of this Part of this Act, be entitled or subject, as from the date of transfer, to the exclusion of the previous holders thereof, to all the rights, privileges and advantages and all the liabilities and obligations arising from the holding of those securities, in all respects as if the securities had been duly transferred to the Corporation in accordance with the enactments and rules of law (other than this Act) applicable thereto and everything necessary to make those rights, privileges, advantages, liabilities and obligations fully effective had been duly done.]

(4)[F8Without prejudice to subsection (3) above, all persons concerned with the keeping of the register of the holders of any such securities as are referred to in that subsection shall forthwith register the relevant Corporation therein and the company concerned shall forthwith issue to that Corporation the appropriate documents of title relating to the securities of the company which vest in that Corporation by virtue of this Part of this Act.]

(5)[F8In this section—

“excepted company” means any company—

(a)which before 21st November 1975 a court has ordered to be wound up; or

(b)which before that day has passed a resolution for voluntary winding up; or

(c)of whose property a receiver has been appointed before that date; and

“securities”, in relation to a company, does not include any security forming part of the loan capital of the company, the terms of which enable it to be redeemed, either without notice or upon not more than one year’s notice, at a price not exceeding the nominal amount of the security together with any outstanding interest, at any time after the creation of the security or the expiry of a period not exceeding one year after the creation of the security.]

Textual Amendments

F7S. 19(2) omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(a)

F8S. 19(3)-(5) ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

Modifications etc. (not altering text)

C229.4.1977 appointed under s. 56(1) as aircraft industry vesting date by S.I. 1977/539, art. 2

C31.7.1977 appointed under s. 56(1) as shipbuilding industry vesting date by S.I. 1977/540, art. 2

20 Vesting in acquired company of certain assets of privately-owned companies in same group.U.K.

(1)[F9Subject to subsection (5) below, where immediately before the date of transfer an acquired company was the wholly owned subsidiary of the person from whom it was acquired, any property, rights or liabilities to which this subsection applies shall vest in the acquired company on the date of transfer of the company.]

(2)[F9The property, rights and liabilities to which subsection (1) above applies are any property, rights and liabilities of an associated privately owned company which—

(a)satisfy a vesting condition for the purposes of this section, and

(b)would remain vested in the associated privately owned company but for this section.]

(3)[F9Property, rights and liabilities satisfy a vesting condition for the purposes of this section if—

(a)they are wholly appurtenant to the undertaking carried on by the acquired company, or

(b)they are mainly appurtenant to property, rights or liabilities which are wholly appurtenant to that undertaking, or

(c)they cannot reasonably be severed from property, rights or liabilities of the acquired company or property, rights or liabilities such as are mentioned in paragraph (a) or (b) above.]

F10(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(5)[F11The rights and liabilities under any agreement for the rendering of personal services by any person shall be vested in the acquired company by virtue of this section if, and only if, immediately before the date of transfer, his employment under the agreement was wholly or mainly for the purposes of the undertaking carried on as mentioned in subsection (3) or, as the case may require, subsection (4) above.]

(6)[F11The provisions of Schedule 3 to this Act shall have effect for supplementing the preceding provisions of this section.]

(7)[F11In this section and Schedule 3 to this Act—

“associated privately owned company” means any privately owned company which immediately before the date of transfer was the holding company of an acquired company or the wholly owned subsidiary of a company whose securities do not vest but which was the holding company of an acquiredcompany; and

“privately owned company” means a company whose securities do not vest, and which is not a subsidiary of a company whose securities vest, in either of the Corporations by virtue of this Part of this Act.]

Textual Amendments

F9S. 20(1)-(3) ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

F10S. 20(4) omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(a)

F11S. 20(5)-(7) ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

F1221 Certain loans from associated persons to be treated as securities.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1222 Determination of rights to require the issue of securities or to nominate directors.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

Payments of dividend and interestU.K.

F1223 Control of dividends and interest.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1224 Permitted dividends and interest.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1225 Final payments of dividend and interest.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

Safeguarding of assets, avoidance of certain transactions, etc.U.K.

F1226 Power to acquire securities of certain additional companies.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1227 Removal of company from companies to be acquired.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1228 Prohibition of transfer of certain works.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1229 Recovery of assets transferred away.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1230 Dissipation of assets by transactions involving holders of securities etc.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1231 Onerous transactions: disclaimer and recovery of losses.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1232 Provisions supplementary to section 31.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1233 Supplementary provisions relating to dissipation of assets.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1234 Approvals and undertakings given before passing of Act.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

CompensationU.K.

F1235 Compensation for vesting of securities.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1236 Payment of compensation.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1237 Base value of securities of a listed class.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1238 Base value of other securities.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F1239 The appropriate deduction.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F12Ss. 21-39 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

40 General provisions as to compensation stock.U.K.

(1)[F13Compensation stock shall bear such rate of interest and be subject to such conditions as to repayment, redemption and other matters as the Treasury may determine.]

(2)[F13The Treasury may by regulations made by statutory instrument make provision as to the issue of compensation stock by the Bank of England.]

(3)[F13Regulations under subsection (2) above may contain such incidental or supplementary provisions as the Treasury consider appropriate.]

F14(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(5)[F13Any expenses incurred in connection with the issue or repayment of compensation stock shall be charged on and issued out of the National Loans Fund.]

(6)[F13References in the preceding provisions of this section to compensation stock include references to stock issued by way of compensation in accordance with paragraph 5 of Schedule 4 to this Act.]

Textual Amendments

F13S. 40(1)-(3) (5) (6) ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

F14S. 40(4) omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(a)

Modifications etc. (not altering text)

C4By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that ss. 40(4) and 41(4) are repealed in relation to British Aerospace and that any reference in those provisions (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say, British Shipbuilders)

F1541 Stockholders’ representatives.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F15S. 41 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

Part IIIU.K. Miscellaneous and General

Arbitration and the Arbitration TribunalU.K.

F1642 The arbitration tribunal.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1643 Scottish proceedings.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F1644 Staff and expenses of arbitration tribunal.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

The CorporationsU.K.

45, 46.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F17U.K.

Textual Amendments

F17Ss. 45, 46 repealed by British Aerospace Act 1980 (c. 26, SIF 64), s. 15(2), Sch. 3

F1847 Right of persons to object to practices of British Shipbuilders or their wholly owned subsidiaries.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F18S. 47 omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(4)(a)

F1948 Duty of the Corporations to consult etc. with Northern Ireland state-controlled bodies. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F19S. 48 omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(4)(a)

Modifications etc. (not altering text)

C5S. 48 amended by British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1)

Pensions etc.U.K.

F2049 Provisions as to pension rights. E+W+S

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Extent Information

E1This version of this provision extends to England and Wales and Scotland only; a separate version has been created for Northern Ireland only

Textual Amendments

F20S. 49 omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(4)(a)

Modifications etc. (not altering text)

C6S. 49 amended by British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1).

F2049 Provisions as to pension rights. N.I.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Extent Information

E3This version of this provision extends to Northern Ireland only; a separate version has been created for England and Wales and Scotland only

Textual Amendments

F20S. 49 omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(4)(a)

Modifications etc. (not altering text)

C13S. 49 amended by British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1).

F2150 Compensation for loss of employment, emoluments or pension rights. E+W+S

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Extent Information

E2This version of this provision extends to England and Wales and Scotland only; a separate version has been created for Northern Ireland only

Textual Amendments

F21S. 50 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

Modifications etc. (not altering text)

C7By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that s. 50 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say British Shipbuilders)

F2150 Compensation for loss of employment, emoluments or pension rights. N.I.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Extent Information

E4This version of this provision extends to Northern Ireland only; a separate version has been created for England and Wales and Scotland only

Textual Amendments

F21S. 50 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

Modifications etc. (not altering text)

C14By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that s. 50 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say British Shipbuilders)

InformationU.K.

F2251 Furnishing of information to the Secretary of State.U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F22S. 51 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

52 Restriction on disclosure of information.U.K.

(1)No information obtained under section 51 above shall be disclosed except—

(a)with the consent of the person carrying on the undertaking or business to which related the books, records or other documents from which it was obtained, or

(b)for the purpose of enabling a Corporation or the Secretary of State to discharge their functions under this Act, or

(c)with a view to the institution of, or otherwise for the purpose of, any criminal proceedings pursuant to, or arising out of, this Act.

(2)If a disclosure is made by a person in contravention of subsection (1) above, he shall be guilty of an offence and shall be liable—

(a)on summary conviction, to imprisonment for a term not exceeding 3 months or to a fine not exceeding £200, or both; and

(b)on conviction on indictment, to imprisonment for a term not exceeding 2 years or to a fine, or both.

Liabilities, etc.U.K.

F2353 Liabilities of Corporations etc. U.K.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F23S. 53 omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(4)(a)

Modifications etc. (not altering text)

C8By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that s. 53 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say British Shipbuilders)

GeneralU.K.

54 Service of notices.U.K.

(1)This section shall have effect in relation to any notice or other document required or authorised by or under this Act to be given to or served on any person.

(2)Any such document may be given to or served on the person in question—

(a)by delivering it to him, or

(b)by leaving it at his proper address, or

(c)F24...F24...F24... by sending it by post to him at that address, F24...

F25(d). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3)Any such document may—

(a)in the case of a body corporate, be given to or served on the secretary or clerk of that body;

(b)in the case of a partnership, be given to or served on a partner or a person having the control or management of the partnership business.

(4)For the purposes of this section and section 26 of the M1Interpretation Act 1889 (service of documents by post) in its application to this section, the proper address of any person to or on whom a document is to be given or served shall be his last known address, except that—

(a)in the case of a body corporate or their secretary or clerk, it shall be the address of the registered or principal office of that body;

(b)in the case of a partnership or a person having the control or management of the partnership business, it shall be that of the principal office of the partnership;

and for the purposes of this subsection the principal office of a company registered outside the United Kingdom or of a partnership carrying on business outside the United Kingdom shall be their principal office within the United Kingdom.

(5)If the person to be given or served with any document mentioned in subsection (1) above has specified an address within the United Kingdom other than his proper address within the meaning of subsection (4) above as the one at which he or someone on his behalf will accept documents of the same description as that document, that address shall also be treated for the purposes of this section and section 26 of the Interpretation Act 1889 as his proper address.

(6)If the name or address of any person having an interest in premises to or on whom any document mentioned in subsection (1) above is to be given or served cannot after reasonable enquiry be ascertained, the document may be given or served—

(a)by addressing it to him either by name or by the description of “the owner” or, as the case may be, “the occupier” of the premises and describing them, and

(b)either by delivering it to some responsible person on the premises or by affixing it, or a copy of it, to some conspicuous part of the premises.

Textual Amendments

F24Words in s. 54(2)(c) repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F25S. 54(2)(d) repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

Marginal Citations

55 Administrative expenses.U.K.

Any administrative expenses incurred by the Secretary of State in connection with the provisions of this Act shall be defrayed out of moneys provided by Parliament.

56 Interpretation.U.K.

(1)In this Act, except where the context otherwise requires,—

(a)a company falling within Part I of Schedule 1 or Schedule 2 to this Act, or

(b)a company in respect of which the obligation to give notice under section 26(9) above has arisen, other than an excluded company;

“aircraft industry vesting date” means such date as the Secretary of State may by order made by statutory instrument specify for the purposes of section 19(1) of this Act;

“the Corporations” means British Aerospace and British Shipbuilders, and references to a Corporation shall be construed accordingly;

“date of transfer” shall be construed in accordance with subsection (5) below;

“enactment” includes an enactment of the Parliament of Northern Ireland and a Measure of the Northern Ireland Assembly;

“excluded company” has the meaning assigned to it by section 27(11) above;

“functions” includes powers and duties;

“guided weapon” does not include a torpedo;

“holding company” shall be construed in accordance with [F27section 1159 of the Companies Act 2006];

“loan capital”, in relation to any company, means the securities of the company which do not form part of the share capital;

“mortgage” in relation to Scotland, means a heritable security within the meaning of section 9(8) of the M2Conveyancing and Feudal Reform (Scotland) Act 1970;

“notice of disclaimer” has the meaning assigned to it by section 31(6) above;

“the relevant Corporation”, in relation to a company which comes into public ownership, or in relation to any securities of such a company, means the Corporation in which vest, on the date of transfer, the securities of that company or of the company of which it is a wholly owned subsidiary;

“the relevant vesting date” means—

(a)in relation to British Aerospace or a company which becomes, or would but for the provisions of section 27 of this Act become, a wholly owned subsidiary of British Aerospace, the aircraft industry vesting date

F30(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

“securities”, in relation to a company, means any shares, debentures, debenture stock, loan stock, income notes, income stock, funding certificates and securities of a like nature;

“” includes stock resulting from the conversion of any share into stock;

“shipyard” includes any berth, dock or slipway used for the construction of ships;

“subsidiary” has [F32the meaning given by] s[F27 section 1159 of the Companies Act 2006];

“wholly owned subsidiary” has the same meaning as it has for the purposes of [F33section 1159 of the Companies Act 2006]; and

“works” means, subject to subsection (6) below,—

(a)any factory, within the meaning of the M3Factories Act 1961,

(b)any aerodrome, as defined in [F34section 105(1) of the Civil Aviation Act 1982],

(c)any shipyard which does not fall within paragraph (a) above, and

(d)any premises used by way of trade or business for the purposes of the storage, transport or distribution of any articles or for the supply of electricity or other form of power,

together with any machinery or equipment installed in any such factory, shipyard or premises and any land occupied for the purposes referred to in paragraph (d) above.

(2)For the purposes of this Act, in relation to land in England, Wales or Northern Ireland,—

(a)“own” includes hold on lease;

(b)“rights of ownership” means an estate in fee simple or a lease; and

(c)property owned by a member of a partnership and held by him for the purposes of the partnership shall be deemed to be owned by each of the members of the partnership.

(3)For the purposes of this Act, in relation to land in Scotland,—

(a)“own” includes hold on lease;

(b)[F35 “ rights of ownership ” means—

(i) if the land is feudal property, the estate or interest of the proprietor of the dominium utile, or

(ii)if the land is not feudal property, the estate or interest of the owner, or

(iii)a lease; and]

[F35“rights of ownership” means the rights—

(i)of an owner; or

(ii)of a tenant under a lease;]

(c)property owned by a member of a partnership and held by him for the purposes of the partnership shall be deemed to be owned by the firm.

(4)Any reference in this Act to a company which comes into public ownership is a reference to an acquired company or a company which, on the date of transfer of an acquired company, is a wholly owned subsidiary of that company; and any reference to a company coming into public ownership shall be construed accordingly.

(5)Subject to section 27(7)(b) of this Act, in relation to a company which comes into public ownership, any reference in this Act to the date of transfer is a reference—

(a)in the case of a company falling within Part I of Schedule 1 or Schedule 2 to this Act or the wholly owned subsidiary of such a company, to the relevant vesting date; and

(b)in the case of any other company which comes into public ownership, to the date on which the securities of the company or, as the case may be, of the company of which it is a wholly owned subsidiary vest in a Corporation by virtue of section 26 above.

(6)For the purposes of this Act—

(a)notwithstanding anything in subsection (1) above, the expression “works” does not include any factory, aerodrome, shipyard or other premises or land situated outside the United Kingdom;

(b)the extension, alteration or re-equipment of any works or the replacement of any machinery or equipment therein shall not be deemed to change the identity of the works; and

(c)in determining whether a company is operating any works at a particular time, any temporary closing of the works at that time owing to holidays, repairs or for any other reason shall be disregarded.

(7)For the purposes of this Act the securities of a company to which the same rights attach shall be deemed to constitute a class of securities, and the date of issue of any securities shall be deemed to be the date on which a resolution allotting those securities is passed.

(8)For the purposes of this Act a person controls a company or other body corporate if he is entitled to exercise or to control the exercise of at least one third of the voting power at any general meeting of that body corporate.

Textual Amendments

F26Words in s. 56(1) omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(4)(b)(i)

F27Words in s. 56(1) substituted (1.10.2009) by The Companies Act 2006 (Consequential Amendments, Transitional Provisions and Savings) Order 2009 (S.I. 2009/1941), art. 1(2), Sch. 1 para. 36(3)(b) (with art. 10)

F28S. 56(1) entries repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F29Words repealed by Employment Act 1980 (c. 42, SIF 43:5), s. 20(3), Sch. 2

F30Words in s. 56(1) omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(4)(b)(ii)

F31Words in s. 56(1) omitted (22.3.2013) by virtue of The Public Bodies (Abolition of the Aircraft and Shipbuilding Industries Arbitration Tribunal) Order 2013 (S.I. 2013/686), art. 1(2), Sch. 1 para. 3(3)

F32Words substituted by Companies Act 1989 (c. 40, SIF 27), ss. 144(4), 213(2), Sch. 18 para. 16 (subject to the transitional provisions referred to in S.I. 1990/1392, arts. 2(d), 6)

F33Words in s. 56(1) substituted (1.10.2009) by The Companies Act 2006 (Consequential Amendments, Transitional Provisions and Savings) Order 2009 (S.I. 2009/1941), art. 1(2), Sch. 1 para. 36(3)(c) (with art. 10)

F34Words substituted by Civil Aviation Act 1982 (c. 16, SIF 9), s. 109(2), Sch. 15 para. 18

F35S. 56(3)(b) substituted (S.) (28.11.2004) by Abolition of Feudal Tenure etc. (Scotland) Act 2000 (asp 5), ss. 71, 77(2), Sch. 12 paras. 38 (with ss. 58, 62, 75); S.S.I. 2003/456, art. 2

Marginal Citations

57 Short title and extent.U.K.

(1)This Act may be cited as the Aircraft and Shipbuilding Industries Act 1977.

(2)This Act extends to Northern Ireland.

SCHEDULES

Section 19(1).

SCHEDULE 1U.K. Aircraft Industry

Part IU.K. Companies whose Securities are to Vest in British Aerospace

British Aircraft Corporation Limited

Hawker Siddeley Aviation Limited

Hawker Siddeley Dynamics Limited

Scottish Aviation Limited

Part IIU.K. Qualifying Conditions

1U.K.On 29th October 1974 each of the companies specified in Part I of this Schedule fulfilled the following conditions, namely,—

(a)the company was incorporated and had its principal place of business in Great Britain; and

(b)the company was engaged in manufacturing complete aircraft or guided weapons; and

(c)the aggregate of—

(i)the company’s turnover for the relevant financial year, as stated or otherwise shown in its accounts, and

(ii)the turnover of each of the company’s subsidiaries for the relevant financial year, as stated or otherwise shown in its accounts,

exceeded £7·5 million; and

(d)the company was not a wholly owned subsidiary of a company which fulfilled each of the preceding conditions.

2U.K.In paragraph 1 above—

“aircraft” does not include—

(a)hovercraft;

(b)lighter than air aircraft;

(c)rotary-wing aircraft;

(d)non-motorised and motorised gliders;

(e)aircraft designed to fly unmanned; and

(f)replicas of aircraft of historic interest; and

“relevant financial year”, in relation to a company, means that one of the company’s financial years, within the meaning of the M4Companies Act 1948, for which accounts were last laid before it in general meeting before 29th October 1974.

Marginal Citations

Section 19(2).

F36SCHEDULE 2U.K. Shipbuilding Industry

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F36Sch. 2 omitted (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(a)

Section 20.

SCHEDULE 3U.K. Vesting of Assets of Undertakings in Acquired Companies

1U.K.[F37In this Schedule—

“the principal section” means section 20 of this Act;

“the relevant undertaking” means, in relation to the acquired company, the undertaking carried on as mentioned in subsection (3) or, as the case may require, subsection (4) of the principal section.]

Textual Amendments

F37Sch. 3 ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

2[F37(1)Subject to sub-paragraph (2) below, any question whether any particular property, rights or liabilities vests or vest in the acquired company by virtue of the principal section shall be determined by agreement between the Secretary of State and the associated privately owned company in whom the property, rights or liabilities is or are vested immediately before the date of transfer of the acquired company F38....U.K.

(2)In its application to any question relating to any rights or liabilities in respect of a person’s services sub-paragraph (1) above shall have effect as if the person concerned were required to be a party to the agreement referred to in that sub-paragraph.]

Textual Amendments

F37Sch. 3 ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

F38Words in Sch. 3 para. 2(1) omitted (22.3.2013) by virtue of The Public Bodies (Abolition of the Aircraft and Shipbuilding Industries Arbitration Tribunal) Order 2013 (S.I. 2013/686), art. 1(2), Sch. 1 para. 3(4)

3U.K.[F37Where any rights or liabilities vested in the acquired company by virtue of the principal section are rights or liabilities under an agreement to which an associated privately owned company was a party immediately before the date of transfer, then, except in so far as the context otherwise requires, whether or not the agreement is in writing or of such a nature that rights and liabilities under it could be assigned by that privately owned company, the agreement shall have effect on and after that date as if—

(a)for any reference (however worded and whether express or implied) to the privately owned company there were substituted, with respect to anything falling to be done on or after that date, a reference to the acquired company, and

(b)any reference (however worded and whether express or implied) to a person holding a particular post in the privately owned company were, with respect to anything falling to be done on or after that date, a reference to such person as the acquired company may appoint or, in default of appointment, to the person holding the most nearly equivalent post in the acquired company.]

Textual Amendments

F37Sch. 3 ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

4U.K.[F37Without prejudice to the generality of paragraph 3 above, where any rights or liabilities vest in the acquired company by virtue of the principal section, the acquired company and any other person shall, as from the date of transfer, have the same rights, powers and remedies (and in particular the same rights and powers as to the taking or resisting of legal proceedings) for ascertaining, perfecting or enforcing any right or liability vested in the acquired company by virtue of the principal section as it or he would have had if that right or liability had at all times been a right or liability of the acquired company.]

Textual Amendments

F37Sch. 3 ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

5U.K.[F37Any legal proceedings pending on the date of transfer by or against the privately owned company concerned, in so far as they relate to any property, rights or liabilities vested in the acquired company by virtue of the principal section or to any agreement relating to any such property, rights or liabilities, shall be continued by or against the acquired company to the exclusion of the privately owned company.]

Textual Amendments

F37Sch. 3 ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

6U.K.[F37Without prejudice to the provisions of paragraph 3 above, the vesting of any property, rights or liabilities in the acquired company by virtue of the principal section shall be binding on all other persons, notwithstanding that any transfer of that property or of those rights or liabilities would, apart from this sub-paragraph, have required the consent or concurrence of any other person.]

Textual Amendments

F37Sch. 3 ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

7U.K.[F37Where any property, rights or liabilities which by virtue of the principal section fall to be vested in the acquired company cannot be properly so vested because transfers of that property or those rights or liabilities are governed otherwise than by the law of a part of the United Kingdom, the privately owned company concerned shall take all practicable steps for the purpose of securing that the ownership of the property is or, as the case may be, the rights or liabilities are, effectively transferred to the acquired company, but for the purposes of this Act, other than this paragraph, any such property, rights or liabilities shall continue to be treated as vested in the acquired company by virtue of that section and not by virtue of any steps taken in accordance with this paragraph.]

Textual Amendments

F37Sch. 3 ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

8U.K.[F37Section 12 of the M5Finance Act 1895 (which requires certain Acts to be stamped as conveyances on sale) (including that section as it applies to Northern Ireland) shall not apply to a vesting of property or rights in the acquired company by the principal section; and stamp duty shall not be payable either in Great Britain or in Northern Ireland on any instrument executed in pursuance of paragraph 7 above.]

Textual Amendments

F37Sch. 3 ceases to have effect (22.3.2013) by virtue of The Public Bodies (Abolition of British Shipbuilders) Order 2013 (S.I. 2013/687), art. 1(2), Sch. 1 para. 3(3)(b)

Marginal Citations

Section 29.

[F39SCHEDULE 4]U.K. Acquisition of Certain Assets

Textual Amendments

F39Schs. 4-6 repealed (22.7.2004) by Statute Law (Repeals) Act 2004 (c. 14), Sch. 1 Pt. 16 Group 1

F391U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F392U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F393U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F394U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F395U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F396U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F397U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 35.

[F39SCHEDULE 5]U.K. Satisfaction of Compensation by Issue of Compensation Stock

F391U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F392U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F393U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F394U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F395U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F396U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F397U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F398U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F399U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Modifications etc. (not altering text)

C9By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that para. 9 of Sch. 5 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say, British Shipbuilders)

C10Sch. 5 para. 9 extended by British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1), Sch. 2 para. 5(1)

Section 41.

[F39SCHEDULE 6]U.K. Provisions as to Office of Stockholders’ Representative, Meetings of Holders of Securities and Incidental Matters

Appointment and tenure of officeU.K.

F391U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F392U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F393U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F394U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F395U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Meetings of holders of securitiesU.K.

F396U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F397U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F398U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Procedure at meetingsU.K.

F399U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F3910U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F3911U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F3912U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F3913U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Service of documentsU.K.

F3914U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Modifications etc. (not altering text)

C11By British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1) it is provided that para. 14 of Sch. 6 is repealed in relation to British Aerospace and that any reference in that provision (in whatever terms expressed) to either or both of the Corporations originally established by s. 1 of this Act shall be construed as a reference to the other Corporation so established (that is to say, British Shipbuilders)

C12Sch. 6 para. 14 extended by British Aerospace Act 1980 (c. 26, SIF 64), s. 10(1), Sch. 2 para. 5(2)

SupplementaryU.K.

F3915U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F3916U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F3917U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

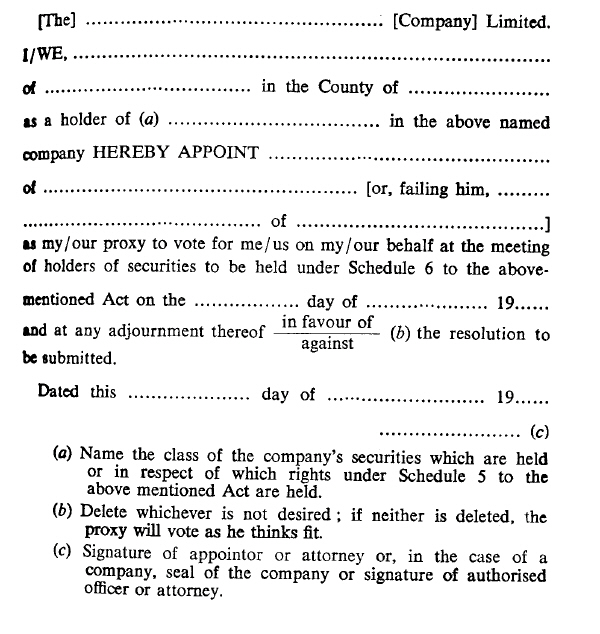

[F39APPENDIX]U.K.

Appointment of proxy for votingU.K.

Section 42.

F40SCHEDULE 7U.K. Procedure Etc. of Arbitration Tribunal

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

Options/Help

Print Options

PrintThe Whole Act

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources