- Latest available (Revised)

- Point in Time (02/02/1991)

- Original (As enacted)

National Heritage Act 1980

You are here:

- UK Public General Acts

- 1980 c. 17

- Whole Act

- Previous

- Next

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes over time for: National Heritage Act 1980

Version Superseded: 21/08/1991

Alternative versions:

- 01/02/1991- Amendment

- 02/02/1991

Point in time - 21/08/1991- Amendment

- 03/07/1992- Amendment

- 01/09/1992- Amendment

- 21/12/1993- Amendment

- 29/08/1995- Amendment

- 04/03/1998- Amendment

- 03/04/1998- Amendment

- 30/06/1999- Amendment

- 20/04/2000- Amendment

- 01/02/2001- Amendment

- 01/12/2003- Amendment

- 22/07/2004- Amendment

- 19/07/2007- Amendment

- 01/10/2012- Amendment

Status:

Point in time view as at 02/02/1991. This version of this Act contains provisions that are not valid for this point in time.![]()

Changes to legislation:

There are outstanding changes not yet made by the legislation.gov.uk editorial team to National Heritage Act 1980. Any changes that have already been made by the team appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

National Heritage Act 1980

1980 CHAPTER 17

An Act to establish a National Heritage Memorial Fund for providing financial assistance for the acquisition, maintenance and preservation of land, buildings and objects of outstanding historic and other interest; to make new provision in relation to the arrangements for accepting property in satisfaction of capital transfer tax and estate duty; to provide for payments out of public funds in respect of the loss of or damage to objects loaned to or displayed in local museums and other institutions; and for purposes connected with those matters.

[31st March 1980]

Modifications etc. (not altering text)

C1Certain functions of the Chancellor of the Duchy of Lancaster which were transferred to the Secretary of State and the Lord President of the Council respectively, by S.I. 1981/207, art. 2(1), Sch. 1 Pt. I and S.I. 1983/879, art. 2(1), Sch. 1 Pt. I retransferred to the Chancellor of the Duchy of Lancaster by S.I. 1984/1814, art. 2, Sch. 1 Pt. I and transferred back to the Lord President of the Council by S.I. 1986/600, art. 2(1), Sch. 1 Pt. I

C2Act: functions of the Lord President transferred to the Secretary of State (3. 7. 1992) by S.I. 1992/1311, art. 3(1), Sch. 1 Pt.I.

Act: certain powers transferred (1.7.1999) by virtue of S.I. 1999/672, art. 2, Sch.1

Commencement Information

I1Act wholly in force at Royal Assent

Part IU.K. The National Heritage Memorial Fund

1 Establishment of National Heritage Memorial Fund.U.K.

(1)There shall be a fund known as the National Heritage Memorial Fund, to be a memorial to those who have died for the United Kingdom, established in succession to the National Land Fund, which shall be applicable for the purposes specified in this Part of this Act.

(2)The Fund shall be vested in and administered by a body corporate known as the Trustees of the National Heritage Memorial Fund and consisting of a chairman and not more than ten other members appointed by the Prime Minister.

(3)The persons appointed under this section shall include persons who have knowledge, experience or interests relevant to the purposes for which the Fund may be applied and who are connected by residence or otherwise with England, Wales, Scotland and Northern Ireland respectively.

(4)References in this Part of this Act to the Trustees are to the body constituted by subsection (2) above; and Schedule 1 to this Act shall have effect with respect to the Trustees and the discharge of their functions.

2 Payments into the Fund.U.K.

(1)[F1The Ministers]. . . F2 shall pay into the Fund in the first month of each financial year a sum determined by [F3them] before the beginning of the year; and [F4the Ministers] may at any time pay into the Fund such further sum or sums as [F3they] may from time to time determine.

(2)There shall also be paid into the Fund any other sums received by the Trustees in consequence of the discharge of their functions.

Textual Amendments

F1Words substituted by S.I. 1983/879, Sch. 2 para. 2(2)

F2Words repealed by S.I. 1981/207, art. 4, art. 10, Sch. 2 para. 4(5)(a)

F3The words “them” and “they” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(4)

F4The words “the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

3 Grants and loans from the Fund.U.K.

(1)Subject to the provisions of this section, the Trustees may make grants and loans out of the Fund to eligible recipients for the purpose of assisting them to acquire, maintain or preserve—

(a)any land, building or structure which in the opinion of the Trustees is of outstanding scenic, historic, aesthetic, architectural or scientific interest;

(b)any object which in their opinion is of outstanding historic, artistic or scientific interest;

(c)any collection or group of objects, being a collection or group which taken as a whole is in their opinion of outstanding historic, artistic or scientific interest;

(d)any land or object not falling within paragraph (a), (b) or (c) above the acquisition, maintenance or preservation of which is in their opinion desirable by reason of its connection with land or a building or structure falling within paragraph (a) above; or

(e)any rights in or over land the acquisition of which is in their opinion desirable for the benefit of land or a building or structure falling within paragraph (a) or (d) above.

(2)The Trustees shall not make a grant or loan under this section in respect of any property unless they are of opinion, after obtaining such expert advice as appears to them to be appropriate, that the property (or, in the case of land or an object falling within paragraph (d) of subsection (1) above, the land, building or structure with which it is connected or, in the case of rights falling within paragraph (e) of that subsection, the land, building or structure for whose benefit they are acquired) is of importance to the national heritage.

(3)In determining whether and on what terms to make a grant or loan under this section in respect of any property the Trustees shall have regard to the desirability of securing, improving or controlling public access to, or the public display of, the property.

(4)In making a grant or loan under this section in respect of any property the Trustees may impose such conditions as they think fit, including—

(a)conditions with respect to—

(i)public access to, or the public display of, the property;

(ii)the maintenance, repair, insurance and safe keeping of the property;

(iii)the disposal or lending of the property; and

(b)conditions requiring the amount of a grant and the outstanding amount of a loan to be repaid forthwith on breach of any condition.

(5)A grant under this section for the purpose of assisting in the maintenance or preservation of any property may take the form of a contribution to a trust established or to be established for that purpose.

(6)Subject to subsection (7) below, the eligible recipients for the purposes of this section are—

(a)any museum, art gallery, library or other similar institution having as its purpose or one of its purposes the preservation for the public benefit of a collection of historic, artistic or scientific interest;

(b)any body having as its purpose or one of its purposes the provision, improvement or preservation of amenities enjoyed or to be enjoyed by the public or the acquisition of land to be used by the public;

(c)any body having nature conservation as its purpose or one of its purposes;

(d)the Secretary of State acting in the discharge of his functions under section 5 of the M1Historic Buildings and Ancient Monuments Act 1953 or section 11(1) or 13 of the M2Ancient Monuments and Archaeological Areas Act 1979; and

(e)the Department of the Environment for Northern Ireland acting in the discharge of its functions under so much of section 1(1) of the M3Historic Monuments Act (Northern Ireland) 1971 as relates to the acquisition of historic monuments by agreement, section 4 of that Act or Article 84 of the M4Planning (Northern Ireland) Order 1972.

(7)The institutions referred to in paragraph (a) of subsection (6) above include any institution maintained by a Minister or Northern Ireland department; but neither that paragraph nor paragraph (b) or (c) of that subsection applies to any institution or body established outside the United Kingdom or established or conducted for profit.

Valid from 04/03/1998

[F53A Financial assistance towards exhibitions, archives, etc.U.K.

(1)The Trustees may give financial assistance for any project within subsection (2) below which appears to them—

(a)to relate to an important aspect of the history, natural history or landscape of the United Kingdom, and

(b)to be of public benefit.

(2)The projects within this subsection are projects for any person to whom the assistance is to be given to—

(a)set up and maintain a public exhibition,

(b)compile and maintain an archive,

(c)publish archive material, or

(d)compile and publish a comprehensive work of reference (or publish a comprehensive work of reference that has previously been compiled),

or to do any ancillary thing.

(3)In subsection (2) above, “archive” includes any collection of sound recordings, images or other information, however stored.

(4)Before giving any financial assistance under this section for any project, the Trustees shall obtain any expert advice about the project they consider appropriate.

(5)Subsections (5), (6) and (8) of section 3 above apply for the purposes of this section as they apply for the purposes of that.

(6)In giving any financial assistance under this section for any project to compile or maintain an archive, or determining the conditions on which such assistance is to be given, the Trustees shall bear in mind the desirability of public access to the archive]

Textual Amendments

F5S. 3A inserted (4.3.1998) by 1997 c. 14, s. 1(2); S.I. 1998/292, art.2

4 Other expenditure out of the Fund.U.K.

(1)Subject to the provisions of this section, the Trustees may apply the Fund for any purpose other than making grants or loans, being a purpose connected with the acquisition, maintenance or preservation of property falling within section 3(1) above, including its acquisition, maintenance or preservation by the Trustees.

(2)Subsections (2) and (3) of section 3 above shall have effect in relation to the application of any sums out of the Fund under this section as they have effect in relation to the making of a grant or loan under that section.

(3)The Trustees shall not retain any property acquired by them under this section except in such cases and for such period as [F6either of the Ministers] may allow.

Textual Amendments

F6The words “either of the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(3)

5 Acceptance of gifts.U.K.

(1)Subject to the provisions of this section, the Trustees may accept gifts of money or other property.

(2)The Trustees shall not accept a gift unless it is either unconditional or on conditions which enable the subject of the gift (and any income or proceeds of sale arising from it) to be applied for a purpose for which the Fund may be applied under this Part of this Act and which enable the Trustees to comply with subsection (3) below and section 2(2) above.

(3)The Trustees shall not retain any property (other than money) accepted by them by way of gift except in such cases and for such period as [F7either of the Ministers] may allow.

(4)References in this section to gifts include references to bequests and devises.

Textual Amendments

F7The words “either of the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(3)

6 Powers of investment.U.K.

(1)Any sums in the Fund which are not immediately required for any other purpose may be invested by the Trustees in accordance with this section.

(2)Sums directly or indirectly representing money paid into the Fund under section 2(1) above may be invested in any manner approved by the Treasury; and the Trustees—

(a)shall not invest any amount available for investment which represents such money except with the consent of the Treasury; and

(b)shall, if the Treasury so require, invest any such amount specified by the Treasury in such manner as the Treasury may direct.

(3)Any sums to which subsection (2) above does not apply may be invested in accordance with the M5Trustee Investments Act 1961; and sections 1, 2, 5, 6, 12 and 13 of that Act shall have effect in relation to such sums, and in relation to any investments for the time being representing such sums, as if they constituted a trust fund and the Trustees were the trustees of that trust fund.

Marginal Citations

7 Annual reports and accounts.U.K.

(1)As soon as practicable after the end of each financial year the Trustees shall make a report to [F8the Ministers] on the activities of the Trustees during that year; and [F8the Ministers] shall cause the report to be published and lay copies of it before Parliament.

(2)It shall be the duty of the Trustees—

(a)to keep proper accounts and proper records in relation to the accounts;

(b)to prepare in respect of each financial year a statement of account in such form as [F8the Ministers] may with the approval of the Treasury direct; and

(c)to send copies of the statement to [F8the Ministers] and the Comptroller and Auditor General before the end of the month of November next following the end of the financial year to which the statement relates.

(3)The Comptroller and Auditor General shall examine, certify and report on each statement received by him in pursuance of this section and lay copies of it and of his report before Parliament.

Textual Amendments

F8The words “the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

Part IIU.K. Property Accepted in Satisfaction of Tax

8 Payments by Ministers to Commissioners of Inland Revenue.U.K.

(1)Where under paragraph 17 of Schedule 4 to the M6Finance Act 1975 [F9or section 230 of the Capital Transfer Tax Act 1984] the Commissioners of Inland Revenue have accepted any property in satisfaction of any amount of capital transfer tax, [F10the Ministers] may pay to the Commissioners a sum equal to that amount.

(2)Any sums paid to the Commissioners under this section shall be dealt with by them as if they were payments on account of capital transfer tax.

(3)Subsections (1) and (2) above shall apply in relation to estate duty chargeable on a death occurring before the passing of the said Act of 1975 as they apply in relation to capital transfer tax; and for that purpose the reference in subsection (1) to paragraph 17 of Schedule 4 to that Act shall be construed as a reference to—

(a)section 56 of the M7Finance (1909-1910) Act 1910;

(b)section 30 of the M8Finance Act 1953 and section 1 of the M9Finance (Miscellaneous Provisions) Act (Northern Ireland) 1954; and

(c)section 34(1) of the M10Finance Act 1956, section 46 of the M11Finance Act 1973, Article 10 of the M12Finance (Northern Ireland) Order 1972 and Article 5 of the M13Finance (Miscellaneous Provisions) (Northern Ireland) Order 1973.

(4)References in this Part of this Act to property accepted in satisfaction of tax are to property accepted by the Commissioners under the provisions mentioned in this section.

Textual Amendments

F9Words inserted by Capital Transfer Tax Act 1984 (c. 51, SIF 65), s. 276, Sch. 8 para. 13

F10The words “the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

Marginal Citations

9 Disposal of property accepted by Commissioners.U.K.

(1)Any property accepted in satisfaction of tax shall be disposed of in such manner as [F11either of the Ministers] may direct.

(2)Without prejudice to the generality of subsection (1) above, [F12either Minister] may in particular direct that any such property shall, on such conditions as he may direct, be transferred to any institution or body falling within section 3(6)(a), (b) or (c) above which is willing to accept it, to the National Art Collections Fund or the Friends of the National Libraries if they are willing to accept it, to the Secretary of State or to the Department of the Environment for Northern Ireland.

(3)Where [F11either of the Ministers] has determined that any property accepted in satisfaction of tax is to be disposed of under this section to any such institution or body as is mentioned in subsection (2) above or to any other person who is willing to accept it, he may direct that the disposal shall be effected by means of a transfer direct to that institution or body or direct to that other person instead of being transferred to the Commissioners.

(4)[F13Either of the Ministers] may in any case direct that any property accepted in satisfaction of tax shall, instead of being transferred to the Commissioners, be transferred to a person nominated by [F14the Ministers]; and where property is so transferred the person to whom it is transferred shall, subject to any directions subsequently given under subsection (1) or (2) above, hold the property and manage it in accordance with such directions as may be given by [F15the Minister].

(5)In exercising [F16their] powers under this section in respect of an object or collection or group of objects having a significant association with a particular place, [F17the Ministers] shall consider whether it is appropriate for the object, collection or group to be, or continue to be, kept in that place, and for that purpose [F17the Ministers] shall obtain such expert advice as appears to [F16them] to be appropriate.

(6)[F18The Ministers] shall lay before Parliament as soon as may be after the end of each financial year a statement giving particulars of any disposal or transfer made in that year in pursuance of directions given under this section.

(7)References in this section to the disposal or transfer of any property include references to leasing, sub-leasing or lending it for any period and on any terms.

Textual Amendments

F11The words “either of the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(3)

F12The words “either Minister” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(5)

F13The words “Either of the Ministers” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(6)(a)

F14The words “the Ministers” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(6)(b)

F15The words “the Minister” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(6)(c)

F16The words “their” and “them” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(4)

F17The words “the Ministers” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

F18The words “The Ministers” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

10 Receipts and expenses in respect of property accepted by Commissioners.U.K.

(1)This section applies where property is accepted in satisfaction of tax and [F19the Ministers][F20have] made a payment in respect of the property under section 8 above.

(2)Any sums received on the disposal of, or of any part of, the property (including any premium, rent or other consideration arising from the leasing, sub-leasing or lending of the property) and any sums otherwise received in connection with the property shall be paid to [F19the Ministers].

(3)Any expenses incurred in connection with the property so far as not disposed of under section 9 above, including in the case of leasehold property any rent payable in respect of it, shall be defrayed by [F19the Ministers].

Textual Amendments

F19The words “the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

F20The word “have” now stands by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(4)

11 Exemption from stamp duty.U.K.

No stamp duty shall be payable on any conveyance or transfer of property made under section 9 above to any such institution or body as is mentioned in subsection (2) of that section or on any conveyance or transfer made under subsection (4) of that section.

12 Approval of property for acceptance in satisfaction of tax.U.K.

(1). . . F21

(2)The power of the Commissioners of Inland Revenue to accept property in satisfaction of estate duty under the provisions mentioned in subsection (3) of section 8 above shall not be exercisable except with the agreement of [F22the Ministers]; and [F22the Ministers] shall exercise the functions conferred on the Treasury by the provisions mentioned in paragraphs (b) and (c) of that subsection. . . F23.

(3)Any question whether an object or collection or group of objects is pre-eminent shall be determined under the provisions mentioned in section 8(3)(b) or (c) above in the same way as under [F24section 230(4) of the Capital Transfer Tax Act 1984].

Textual Amendments

F21S. 12(1) repealed by Capital Transfer Tax Act 1984 (c. 51, SIF 65), s. 277, Sch. 9

F22The words “the Ministers” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

F23Words repealed by Capital Transfer Tax Act 1984 (c. 51, SIF 65), s. 277, Sch. 9

F24Words substituted by Capital Transfer Tax Act 1984 (c. 51, SIF 65), s. 276, Sch. 8 para. 14

13 Acceptance of property in satisfaction of interest on tax.U.K.

(1). . . F25

(2)References to estate duty in—

(a)the provisions mentioned in section 8(3) above; and

(b)section 32 of the M14Finance Act 1958 and section 5 of the M15Finance Act (Northern Ireland) 1958,

shall include references to interest payable under section 18 of the M16Finance Act 1896.

(3)Section 8 above shall have effect where by virtue of this section [F26or section 230(1) or 231(2) of the Capital Transfer Tax Act 1984] property is accepted in satisfaction of interest as it has effect where property is accepted in satisfaction of capital transfer tax or estate duty and references in this Part of this Act to property accepted in satisfaction of tax shall be construed accordingly.

Textual Amendments

F25S. 13(1) repealed by Capital Transfer Tax Act 1984 (c. 51, SIF 65), s. 277, Sch. 9

F26Words inserted by Capital Transfer Tax Act 1984 (c. 51, SIF 65), s. 276, Sch. 8 para. 15

Marginal Citations

14 Transfer of Ministerial functions.U.K.

(1)Her Majesty may by Order in Council provide for the transfer to the Trustees of the National Heritage Memorial Fund of any functions exercisable by [F27the Ministers or either of them] under any of the provisions of this Part of this Act [F28or under section 230 of the Capital Transfer Tax Act 1984].

(2)An Order under this section may contain such incidental, consequential and supplemental provisions as may be necessary or expedient for the purpose of giving effect to the Order, including provisions adapting any of the provisions referred to in subsection (1) above.

(3)No Order shall be made under this section unless a draft of the Order has been laid before, and approved by a resolution of, each House of Parliament.

Textual Amendments

F27The words “the Ministers or either of them” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(7)

F28Words substituted by Capital Transfer Tax Act 1984 (c. 51, SIF 65), s. 276, Sch. 8 para. 16

15 Abolition of National Land Fund.U.K.

(1)Sections 48, 50 and 51 of the M17Finance Act 1946 (which establish the National Land Fund for the purpose of making such payments as are mentioned in section 8 above and contain other provisions superseded by this Part of this Act) and section 7 of the M18Historic Buildings and Ancient Monuments Act 1953 (which enables payments to be made out of that Fund for various other purposes) shall cease to have effect.

(2)Subsection (1) above does not affect subsection (4) of the said section 48 (accounts) in relation to any receipts into or payments out of the National Land Fund at any time before that section ceases to have effect.

(3)The Treasury shall, within six months of the date on which the said section 48 ceases to have effect, cancel all investments of the National Land Fund in debt charged on the National Loans Fund.

Modifications etc. (not altering text)

C3The text of ss. 15(1), 18(5), Sch. 2 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

Marginal Citations

Part IIIU.K. Miscellaneous and Supplementary

16 Indemnities for objects on loan.U.K.

(1)Subject to subsections (3) and (4) below, [F29either of the Ministers] may, in such cases and to such extent as he may determine, undertake to indemnify any institution, body or person falling within subsection (2) below for the loss of, or damage to, any object belonging to that institution, body or person while on loan to any other institution, body or person falling within that subsection.

(2)The institutions, bodies and persons referred to above are—

(a)a museum, art gallery or other similar institution in the United Kingdom which has as its purpose or one of its purposes the preservation for the public benefit of a collection of historic, artistic or scientific interest and which is maintained—

(i)wholly or mainly out of moneys provided by Parliament or out of moneys appropriated by Measure; or

(ii)by a local authority or university in the United Kingdom;

(b)a library which is maintained—

(i)wholly or mainly out of moneys provided by Parliament or out of moneys appropriated by Measure: or

(ii)by a library authority;

or the main function of which is to serve the needs of teaching and research at a university in the United Kingdom;

(c)the National Trust for Places of Historic Interest or Natural Beauty;

(d)the National Trust for Scotland for Places of Historic Interest or Natural Beauty; and

(e)any other body or person for the time being approved for the purposes of this section by [F29either of the Ministers] with the consent of the Treasury.

(3)[F30Neither of the Ministers shall] give an undertaking under this section unless he considers that the loan will facilitate public access to the object in question or contribute materially to public understanding or appreciation of it.

(4)[F30Neither of the Ministers shall] give an undertaking under this section unless the loan of the object in question is made in accordance with conditions approved by him and the Treasury and [F31the Minister] is satisfied that appropriate arrangements have been made for the safety of the object while it is on loan.

(5)Subsections (1) to (4) above shall apply in relation to the loan of an object belonging to an institution, body or person established or resident in Northern Ireland with the substitution for references to [F29either of the Ministers] and the Treasury of references to the Department of Education for Northern Ireland and the Department of Finance for Northern Ireland respectively.

(6)In subsection (2) above “library authority” means a library authority within the meaning of the M19Public Libraries and Museums Act 1964, a statutory library authority within the meaning of the M20Public Libraries (Scotland) Act 1955 or an Education and Library Board within the meaning of the M21Education and Libraries (Northern Ireland) Order 1972 and “university” includes a university college and a college, school or hall of a university.

(7)References in this section to the loss of or damage to, or to the safety of, an object while on loan include references to the loss of or damage to, or the safety of, the object while being taken to or returned from the place where it is to be or has been kept while on loan.

Textual Amendments

F29The words “either of the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(3)

F30Words substituted by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(8)(a)

F31Words “the Minister” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(8)(b)

Marginal Citations

Valid from 01/09/1992

[F3216A Reporting of indemnities given under section 16.U.K.

(1)For each of the successive periods of six months ending with 31st March and 30th September in each year, [F33the Secretary of State] shall prepare a report specifying—

(a)the number of undertakings given by him under section 16 above during that period; and

(b)the amount or value, expressed in sterling, of any contingent liabilities as at the end of that period in respect of such of the undertakings given by him under that section at any time as remain outstanding at the end of that period.

(2)A report under subsection (1) above shall be laid before Parliament not later than two months after the end of the period to which it relates.

(3)Subsections (1) and (2) above shall apply in relation to undertakings given under section 16 above by the Department of Education for Northern Ireland—

(a)with the substitution for references to [F33the Secretary of State] of references to that Department; and

(b)with the substitution for the reference to Parliament in subsection (2) of a reference to the Northern Ireland Assembly.]

Textual Amendments

F32S. 16A inserted (1. 9. 1992) by Museums and Galleries Act 1992 (c. 44), s. 10(2); S.I. 1992/1874, art.2.

F33Words in s. 16A(1)(3)(a) substituted (3. 7. 1992) by S.I. 1992/1311, art. 12(2), Sch. 2 para. 5(5).

17 Expenses and receipts.U.K.

Any sums required by any Minister for making payments under this Act shall be defrayed out of moneys provided by Parliament, and any sums received by any Minister under this Act shall be paid into the Consolidated Fund.

18 Short title, interpretation, repeals and extent.U.K.

(1)This Act may be cited as the National Heritage Act 1980.

(2)In this Act—

“financial year” means the twelve months ending with 31st March;

. . . F34

[F35“the Ministers” means the Secretary of State and [F36the Lord President of the Council]];

(3). . . F37

(4)References in this Act to the making of a grant or loan or the transfer or conveyance of any property to any institution or body include references to the making of a grant or loan or the transfer or conveyance of property to trustees for that institution or body.

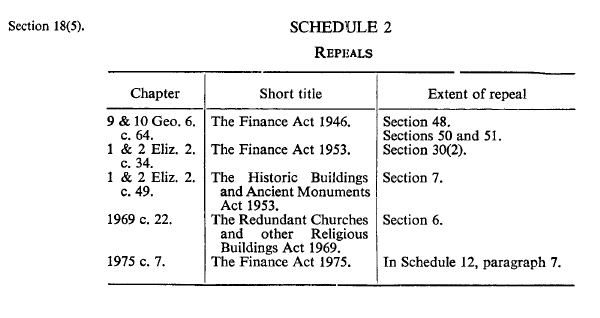

(5)The enactments mentioned in Schedule 2 to this Act are hereby repealed to the extent specified in the third column of that Schedule.

(6)This Act extends to Northern Ireland.

Textual Amendments

F34Definition of “the Ministers” repealed by S.I. 1981/207, art. 4, Sch. 2 para. 4(5)(c)

F35Definition inserted by S.I. 1983/879, art. 10, Sch. 2 para. 2(9)

F36Words substituted by virtue of S.I. 1984/1814, arts. 2, 7(1) and 1986/600, arts. 2(1), 7, Sch. 1 Pt. 1

F37S. 18(3) repealed by S.I. 1981/207, art. 4, Sch. 2 para. 4(5)(d)

Modifications etc. (not altering text)

C4The text of ss. 15(1), 18(5), Sch. 2 is in the form in which it was originally enacted: it was not reproduced in Statutes in Force and does not reflect any amendments or repeals which may have been made prior to 1.2.1991.

SCHEDULES

Section 1(4).

SCHEDULE 1U.K. The Trustees of the National Heritage Memorial Fund

StatusU.K.

1U.K.The Trustees shall not be regarded as acting on behalf of the Crown and neither they nor their officers or servants shall be regarded as Crown servants.

2U.K.[F38Section 40 of the M22General Rate Act 1967 (relief for charities and other organisations)][F38Sections 43(6), 45(6) and 47 of the Local Government Finance Act 1988], section 4 of the M23Local Government (Financial Provisions etc.) (Scotland) Act 1962 (corresponding provisions for Scotland) and Article 41 of the M24Rates (Northern Ireland) Order 1977 (corresponding provisions for Northern Ireland) shall apply to any hereditament, lands and heritages occupied by the Trustees for the purposes of this Act as they apply to a hereditament, lands and heritages occupied by trustees for a charity.

Textual Amendments

F38Words “Sections 43(6), 45(6) and 47 of the Local Government Finance Act 1988” substituted (E.W.)for “Section 40 of the General Rate Act 1967 (relief for charities and other organisations)” by S.I. 1990/776, arts. 2(2), 8, Sch. 3 para. 20

Marginal Citations

Tenure of office of trusteeU.K.

3(1)Subject to the provisions of this paragraph, a member of the body constituted by section 1(2) of this Act (in this Schedule referred to as “a trustee”) shall hold and vacate his office in accordance with the terms of his appointment.

(2)A person shall not be appointed a trustee for more than three years.

(3)A trustee may resign by notice in writing to the Prime Minister.

(4)The Prime Minister may terminate the appointment of a trustee if he is satisfied that—

(a)for a period of six months beginning not more than nine months previously he has, without the consent of the other trustees, failed to attend the meetings of the trustees;

(b)he is an undischarged bankrupt or has made an arrangement with his creditors or is insolvent within the meaning of paragraph 9(2)(a) of Schedule 3 to the M25Conveyancing and Feudal Reform (Scotland) Act 1970;

(c)he is by reason of physical or mental illness, or for any other reason, incapable of carrying out his duties; or

(d)he has been convicted of such a criminal offence, or his conduct has been such, that it is not in the Prime Minister’s opinion fitting that he should remain a trustee.

(5)A person who ceases or has ceased to be a trustee may be re-appointed.

Marginal Citations

Tenure of office of chairmanU.K.

4(1)Subject to the provisions of this paragraph, the chairman of the Trustees shall hold and vacate his office in accordance with the terms of his appointment.U.K.

(2)The chairman may resign his office by notice in writing to the Prime Minister.

(3)A trustee who ceases or has ceased to be chairmen may be reappointed to that office.

(4)If the chairman ceases to be a trustee he shall also cease to be chairman.

Valid from 04/03/1998

[F39Remuneration]U.K.

Textual Amendments

F39S. 4A and crossheading inserted (4.3.1998) by 1997 c. 14, s. 2(a); S.I. 1997/292, art.2

[F404AU.K.There may be paid out of the Fund to a trustee such remuneration, on such terms and conditions, as the Secretary of State may approve.]

Textual Amendments

F40Sch. 1 para. 4A and crossheading inserted (4.3.1998) by 1997 c. 14, s. 2(a); S.I. 1998/292, art.2

Expenses and allowancesU.K.

5(1)All administrative and other expenses incurred by the Trustees in discharging their functions under this Act shall be defrayed out of the Fund.

(2)There may be paid out of the Fund to a trustee such allowances as [F41the Ministers] may with the consent of the Minister for the Civil Service approve.

Textual Amendments

F41The words “the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

Modifications etc. (not altering text)

C5For the reference to the Minister for the Civil Service there is substituted a reference to the Treasury by S.I. 1981/1670, arts. 2(1)(c), 3(5)

StaffU.K.

6The Trustees may, after consultation with [F42the Ministers], appoint such officers and servants as they think fit but the number appointed shall require the approval of [F42the Ministers] and the remuneration to be paid, any provisions as to superannuation and the other terms and conditions of service shall require the approval of [F42the Ministers] given with the consent of the Minister for the Civil Service.

Textual Amendments

F42The words “the Ministers” now stand by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

Modifications etc. (not altering text)

C6For the reference to the Minister for the Civil Service there is substituted a reference to the Treasury by S.I. 1981/1670, arts. 2(1)(c), 3(5)

ProceedingsU.K.

7(1)Subject to the provisions of this Act—

(a)the Trustees shall discharge their functions in accordance with such arrangements as they may determine; and

(b)those arrangements may provide for any function to be discharged under the general direction of the Trustees by a committee or committees consisting of three or more trustees.

(2)Anything done by a committee under the arrangements shall, if the arrangements so provide, have effect as if done by the Trustees.

(3)The validity of any proceedings of the Trustees shall not be affected by any vacancy among the trustees or by any defect in the appointment of a trustee.

(4)The arrangements made under this paragraph may include provisions specifying a quorum for meetings of the Trustees and any committee; and until a quorum is so specified in relation to meetings of the Trustees the quorum for such meetings shall be such as may be determined by [F43the Ministers].

Textual Amendments

F43The words “the Ministers” now stand in the text by virtue of S.I. 1983/879, art. 10, Sch. 2 para. 2(2)

U.K.

Options/Help

Print Options

PrintThe Whole Act

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources